Tuesday, August 14, 2012

Tuesday, August 14, 2012

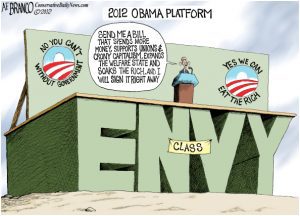

The nerve of me. I’m nobody, and yet here I am telling you that monetary and fiscal policies, the traditional versions of them, don’t work. I might as well be telling you that prayer may make you feel like you’re doing something, but it doesn’t really accomplish anything, that any sense that it does is just wishful thinking and, in any case, impossible to prove. It is, of course, a flawed analogy, used only to make a point. The difference is that prayer is a matter of belief, while the efficacy of monetary and fiscal policy is science, social science, but science nonetheless. We don’t want elected officials who believe in the power of government. We want a President and legislators who understand the science of using government resources for the common good.

Continue reading →

Saturday, August 25, 2012

Saturday, August 25, 2012

Thursday, August 23, 2012

Thursday, August 23, 2012 Wednesday, August 22, 2012

Wednesday, August 22, 2012 Tuesday, August 14, 2012

Tuesday, August 14, 2012 Sunday, August 13, 2012

Sunday, August 13, 2012 Saturday, August 11, 2012

Saturday, August 11, 2012

Tuesday, July 31, 2012

Tuesday, July 31, 2012