Almost everybody is in agreement that Baltimore needs to lower its property tax rate which, at 2.248%, is almost twice that of the next highest county rate in the state. The rate is so high that it’s discouraging people and employers from moving here – and encouraging people and businesses to leave. We have a consensus. The question isn’t whether or not we lower the rate, but by what means and how quickly.

Almost everybody is in agreement that Baltimore needs to lower its property tax rate which, at 2.248%, is almost twice that of the next highest county rate in the state. The rate is so high that it’s discouraging people and employers from moving here – and encouraging people and businesses to leave. We have a consensus. The question isn’t whether or not we lower the rate, but by what means and how quickly.

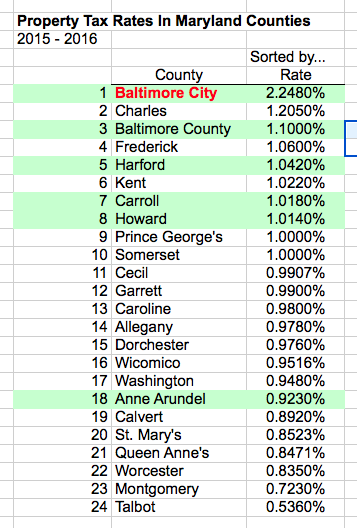

The table on the right shows the property tax rates for all 24 Maryland counties, including Baltimore City. The rates are sorted in descending order. The counties highlighted in green are those where most of the people who commute to Baltimore live. Those are the counties which are the city’s primary competition.

People have been making suggestions about how to lower the rate for some time now.

Usually, they offer a plan over 10 to 20 years during which they propose to drop the rate,

in small annual increments totaling, let’s say, 50%. What they’re concerned about, of course, is how we fund our government when we lower the rate and property tax revenues fall off. So what they do is estimate how lowering the rate, very gradually, will repopulate the city and push tax revenues up by more than enough to protect the city’s revenues.

Needless to say, making projections of that sort is difficult to impossible. For one thing, lowering the rate on Monday, figuratively speaking, doesn’t produce repopulation on Tuesday. There’s going to be a lag that is both considerable and unpredictable. And how are we going to fund the city in the meantime? And then there is that pesky problem of there not being sufficient data on which to base these projections of how people and businesses will respond to gradual, relatively minor adjustments to the rate. This isn’t hard science that we’re talking about. More often than not, the projections being made range from highly questionable to junk.

In any case, life is too short to spend the time trying to come up with a formulaic plan that may or may not work – over 10 to 20 years, no less. Our strategy, by comparison, is simpler and, we think, more reliable. More likely to produce the desired results and at an accelerated pace.

Here’s what we’re going to do…

- There are over 34,000 vacant properties in the city. Roughly half are vacant lots. The other half have structures on them. We want the city to give them a way. For free. Not all of them, of course. Only the ones the city owns and only to families and employers who are willing to turn these properties into homes and operating businesses quickly. (No development “on spec” or land banking will be allowed.)

- We’re going to give them to people who will refurbish or build new housing and live there. We’re going to give them to employers who agree to locate in the heart of the city’s disadvantaged neighborhoods and agree to hire from among the local un- and under-employed.

- And we’re going to forgive property taxes on these properties for 5 to 10 years.

There are rules, details of course, but that’s what we’re proposing to do in new legislation we’re submitting with the assistance of a Member of the City Council.

Is our offer too aggressive for you? Why not just give them a break on property taxes and let them bid on the vacant properties? The simple, albeit painful answer is that there’s so much wrong with living or operating in the city that saving some money on property tax won’t cut it, won’t get the attention of people who can afford to live or operate, if they’re employers, in the suburbs.

Notice that we’re only giving away properties on which the city is not currently collecting any property taxes, so there’s no reduction in property tax revenues. Other proposals would have the city suffer a loss of property tax revenues in advance of what is hoped will be the growth that lower tax rates might encourage. That’s how the other plans work. Not ours, because we’re giving away property on which tax revenues are currently $0.

- For free land, free buildings and no property taxes for 5 to 10 years, people and employers bite. We don’t produce any property taxes for the city, not for 5 to 10 years on the properties we give away, but we do produce income tax revenues – our share of what the state collects. More importantly, resultant new employment and consumer expenditures stimulate business development in the immediate vicinity of the people and employers we have attracted to the city.

And that, ladies and gentlemen, is what used to be called “priming the pump.” Without ever reducing property tax revenues to the city, our approach produces some increased income tax revenues. Most importantly, we produce indirect, sometimes called “multiplier” effects that propagate throughout the effected neighborhoods and greater communities around them.

That’s the priming the pump part, but here’s the real trick… Our approach will produce badly needed, increased property and income tax revenues for the city. Understandably, the temptation will be to spend those increased revenues for essential services. And we should spend a portion of those increased revenues for government services, but only a portion. For now, most of these additional tax revenues need to be directed to lowering the current property tax rate as quickly as possible.

And that’s how our program to lower property tax rates works. No projections. No interim reductions in tax revenues, only increases.