Screenshot from the Baltimore Development Corporation website. Note the BDC’s slogan. Catchy, but what exactly does it mean?

Let’s talk briefly about TIFs. “To TIF or not to TIF?” isn’t really the question, but it makes for a catchy title. The real question isn’t whether or not, but where.

“Excuse me.”

Yes?

“What’s a TIF?”

Excellent question. “TIF” stands for Tax Increment Financing. It’s one of the most powerful tools that our city government has to encourage economic development. It’s simple really.

- The government identifies a property, the development of which would be beneficial to the city’s economy. Could be the city’s idea or a property that a developer has brought to the city’s attention.

- The current value of the property is significantly lower than the value of the property after it’s developed. The city is hungry for property tax revenues, so it wants the project to go forward. The more valuable the property – and the properties around it when the project is completed – the greater the property taxes the city stands to collect.

- Problem: For whatever reasons, the developer can’t justify proceeding without financial help. Maybe, for example, the project requires improvements to the local streets, water and sewer facilities that are so expensive, the project can’t support them. Either the city pays for those improvements or the project doesn’t happen.

- Solution: The city borrows from the bond market – issues bonds, that is – secured by the incremental property taxes the project will pay over some period, such as 20 years. The city then uses what it borrows to pay for the infrastructure the project needs.

The project, once it’s completed, still pays property taxes. It’s just that the difference, the “incremental property taxes” are used to pay principal and interest on the bonds.

And that’s how a TIF works.

“Makes sense.”

Yes it does – provided, of course, that the projects the city picks are worth it and represent the best use of these funds. And that’s what this post is really all about.

In Baltimore, TIFs are granted by the city through the Baltimore Development Corporation (“BDC”) headed by former Councilman from the 11th District, William Cole. Mr. Cole was appointed in 2014 by the Mayor. The BDC, which we’ll talk more about in later articles, is an independent, non-profit 501(c)(3) organization under contract with the city. It is noticeably reluctant to release information about how it picks the projects it funds and the success of those projects financially, for the neighborhoods in which they are located and for the city overall.

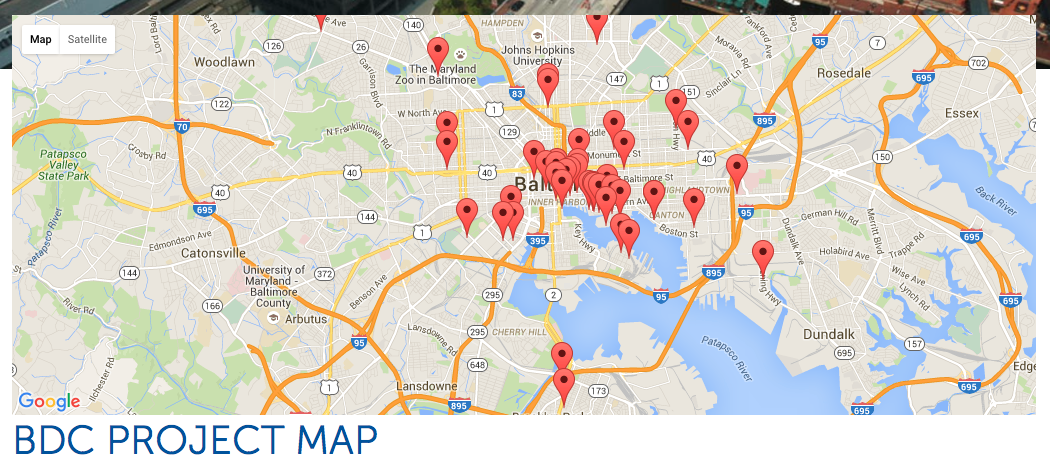

FOIA (Freedom of Information Act) requests – directed at the city, not at the BDC which is a privately-held organization, may be necessary for us to fully understand how this organization works. The best we can do for now is take a look at the recent projects map the Baltimore Development Corporation displays on its website.

The markers you see in the screenshot above are projects on which the city, through the BDC, has spent literally hundreds of millions of dollars. As you can see, almost all of these projects are downtown, either in or near Mr. Cole’s Council district. In any case, what’s striking is not so much where they are, but where aren’t. Where they aren’t is in the city’s disadvantaged neighborhoods that are desperate for employment and commerce.

Just think of what those hundreds of millions of dollars might have accomplished had they been invested elsewhere in the city.

Coming soon… Baltimore Rising’s suggestions as to how the city’s TIF money might be better deployed to generate employment and economic growth, to repopulate the city and increase our property tax and income tax base.