Cutting property taxes is something we really, really need to do. Our rate, which is 2.248%, is almost twice that of the next highest county rate in the state. The rate in Charles County is 1.205%. If you were thinking maybe it was Howard County, the rate there is only 1.014%. Howard County doesn’t need a high property tax rate because its median household income is over $100,000, housing is much more expensive and the county isn’t spending $750 million a year on public safety.

Cutting property taxes is something we really, really need to do. Our rate, which is 2.248%, is almost twice that of the next highest county rate in the state. The rate in Charles County is 1.205%. If you were thinking maybe it was Howard County, the rate there is only 1.014%. Howard County doesn’t need a high property tax rate because its median household income is over $100,000, housing is much more expensive and the county isn’t spending $750 million a year on public safety.

To give you a sense of how much it costs to own a house in Baltimore, the median value of housing in Baltimore, 2009-2013 according to the Bureau of the Census, is $157,900. So half the homes are worth less than that. The other half are worth more.

Round numbers, a $150,000 home is paying $3,372 per year in property taxes. That’s a lot of money, particularly if you’re not making all that much and people living in $150,000 homes are probably not. As a rule, the more you make, the more expensive house you own and you pay proportionately higher property taxes. The same 2.248% applies to everyone. It just hurts more, the less you earn.

Because the current rate is difficult for so many of our families – even as a pass-through that’s built into their rent if they’re not homeowners – and because the high rate is discouraging people and businesses from moving here, we need to lower our property tax rate. But how? How do we do that?

Unfortunately, our city government is struggling to remain solvent. The city is already cutting programs, reducing employee and retire benefits, selling off income-producing assets and delaying critically needed maintenance and repair of infrastructure. Cutting back even more to accommodate a reduction in property tax rates and revenues just isn’t an option.

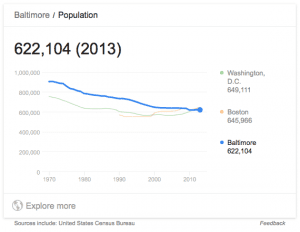

No. If we’re going to reduce property taxes, the only way we’re going to do it is by repopulating the city with people, of course – maybe some of the over 100,000 people who commute here to work every day? – and businesses/employers.

“But how do we do that if we can’t afford to lower our property taxes which are so high we can’t compete with the suburbs?”

Good question.

Keep in mind that property taxes aren’t the only reason people don’t live here. There’s also the fear of being mugged or shot, the underperforming public schools and other social reasons. So just lowering property taxes may not be enough to get the job done.

Good news. You know all that vacant and abandoned property in the city? All that property where the 300,000+ people we’ve lost since 1950 and all the businesses they supported used to live? Well, folks, those properties aren’t paying any property taxes now or stimulating any economic benefit for the city. Quite to the contrary. It’s one depressing eyesore. Okay, so let’s give it away to people and employers who will move here. There’s no downside. We’re in trouble and we’ve got nothing to lose.

That’s right. Give the city-owned portion of all these properties away – with no property taxes for the first 5 years. Just give it away. For free.

So, as an incentive to move yourself or your business to Baltimore, you get free property and no property taxes for a while. (No land-banking allowed. You’ll have to own and develop the property within 12 months of the transfer.) We think there are a lot of people who will take that deal.

True, they’re not going to be paying taxes for a while so that doesn’t help us lower our property tax rate, not directly, but then nothing stimulates organic – local, naturally originating, program-free growth – more than growth itself. The Depression era expression was what we’re proposing was “priming the pump.”

And that, ladies and gentlemen, is the way and quite possibly the only way we’re going to lower the city’s property tax rate.

Don’t like this option? Get over it – or comment us back and propose a better solution of your own.