Given a choice between investing in horse racing or our children’s education, which one do you pick?

Given a choice between investing in horse racing or our children’s education, which one do you pick?

I don’t know about you, but I like pie. Cherry pie, in particular, apple and key lime, but also pizza and charts.

Hey. As you may know, we did some work recently having to do with the MGM National Harbor casino.

“So what? …I’m hungry and I thought this post had something to do with pie.”

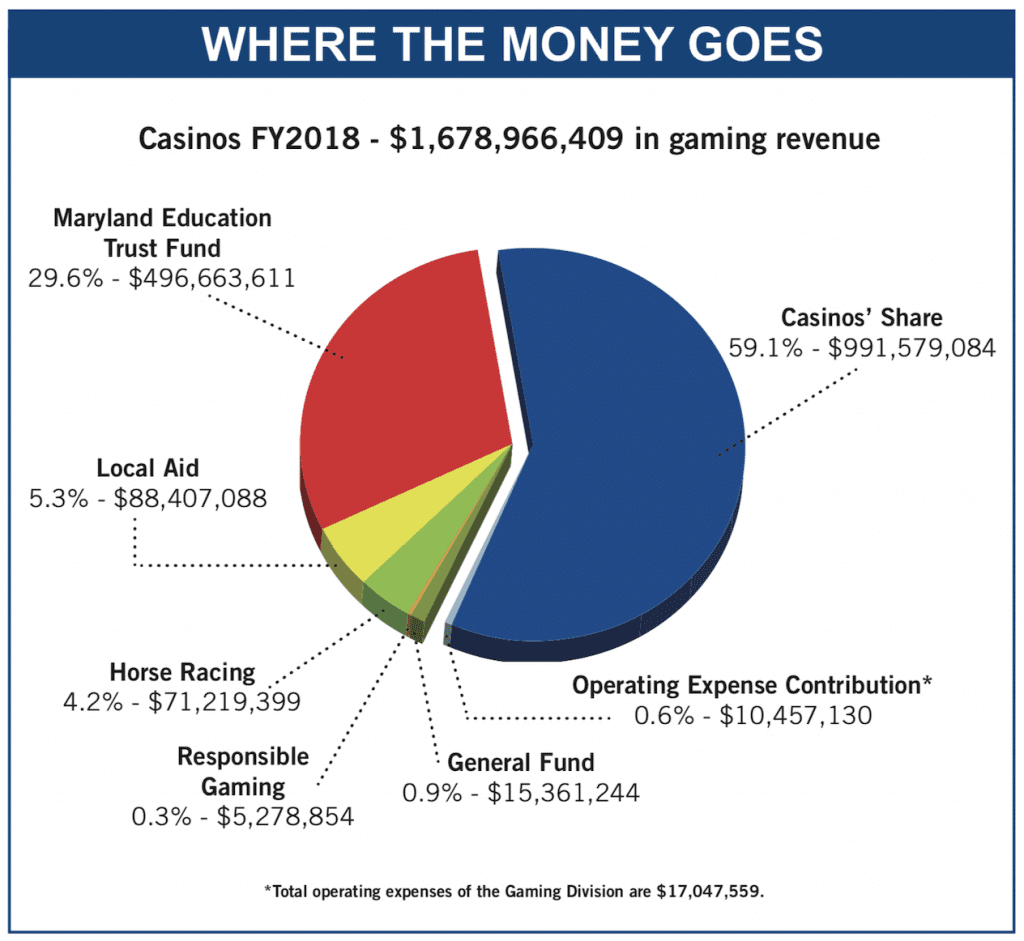

It does. …So we were responding to inquiries from good people who live in Prince George’s County who have some serious questions and, in the process of helping them out, we came across the following pie chart…

As you can see, it shows how revenues from the state’s six casinos are dispersed. Notice, for example, the almost half a billion dollars ($496,663,611) for the Maryland Education Trust Fund that was generated in Fiscal 2018 from slot machine and table games activity combined.

But what’s that 4.2% ($71,219,399) for horse racing? That’s 4.2% of total revenues from slot machines and table games.

As it turns out, Maryland law mandates that 6.0% of casino slot machine revenues – just from slot machine revenues – be paid monthly to the Maryland Racing Commission for “Purse Dedication,” plus another 1% of slot machine revenues for the “Race Tracks Facility Renewal Accounts.” That’s a total of 7% of slot machine revenues which is what the pie chart is showing as 4.2% of total revenues from slot machines and table gaming combined.

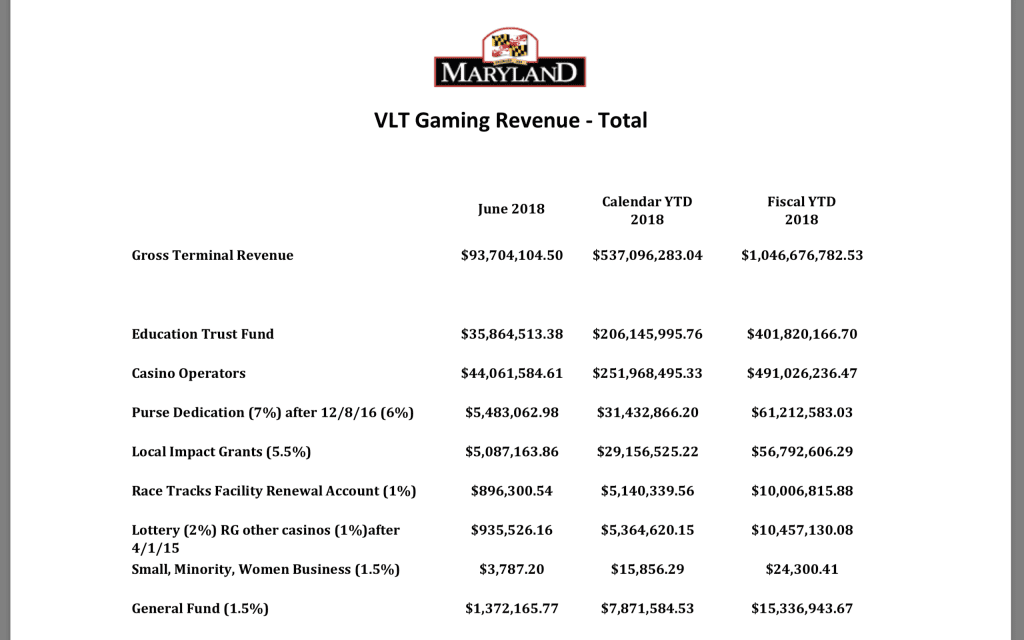

See the screenshot below of the MDGaming.com website page that shows the distribution of June 2018 revenues from casino slot machines. Note, in particular, the column entitled “Fiscal YTD 2018.” The $71,219,399 is the sum of $61,212,583 for “Purse Dedication” plus $10,006,816 for “Racetracks Facility Renewal.”

So, in Fiscal 2018 (July 1, 2018 – June 30, 2018), a whopping $71,219,399 of the taxes collected from Maryland’s 6 casinos went to the Maryland Horse Racing Commission – and to the tracks the Commission regulates.

“Wow. That’s a lot of money. I didn’t know that.”

Don’t feel bad. Not many people do, which is the whole point of this article.

In case you’re wondering, funds for “Purse Dedication” are used to increase purses paid at Maryland race tracks, that is, to make those purses higher, much higher than betting would otherwise justify. Why pump up the payoffs? To attract more attention to the races, not just among bettors in Maryland, but elsewhere in the country where people can bet on these races without actually coming to the track. We (Marylanders) don’t earn any taxes from out-of-state betting, not on the betting itself that is. But the tracks make money from out-of-state betting. And those commissions are taxed like ordinary corporate income when the tracks pay their taxes.

High stakes racing and winnings by Maryland-bred horses also helps Maryland’s horse breeding industry.

Needless to say – but we’ll say it anyway – these transfers of casino taxes to the Horse Racing Commission are huge sums of money that, obviously, might better be spent on education and/or to help improve other social services. So why support horse racing? And who, exactly, are these millions and millions of subsidies helping?

Well, for one thing, horse breeding and racing are significant Maryland businesses. But then so was the manufacturing of Maryland steel on Sparrow’s Point and elsewhere. That’s all gone, although steel manufacturing in Maryland may be staging a minor, but materially significant comeback. As for horse racing, it’s struggling. Wagers on in-state thoroughbred racing have fallen from $337,652,117 in 2001 to only $94,123,538 in 2017, a drop of 72.1%.

“That’s huge.”

Yeah. It really is. The question is, why is the state investing $71,219,399 per year, in Fiscal 2018 alone, to save an industry in which the people of Maryland are losing interest?

Racing in Maryland has been on the decline – despite these very substantial subsidies, in recent years, from casino revenues. So are the subsidies a good idea? More to the point, are they the best use of these tax revenues? That depends. It depends upon priorities set by our government and supported, one way or another, by voters.

No question about it. Despite the substantial subsidies that we’re talking about, Maryland’s horse racing tracks are suffering from a serious loss of public interest. Consider the following data for thoroughbred racing taken from the Maryland Racing Commission 2017 Annual Report for calendar 2017…

– In the 5 years between 2012 and 2017, there has been an 8.0% increase in the number of thoroughbred racing days at Maryland tracks.

– Over those same 5 years, there has been a 40.4% decrease in wagers placed at Maryland’s two thoroughbred tracks. That’s right, not including the Timonium Fair Grounds where the State Fair is held every year, there are only two thoroughbred racing tracks in Maryland, Pimlico and Laurel. They are both owned by the same company, The Stronach Group, which is a Canadian firm whose owner, Frank Stronach, helped Governor O’Malley get elected.

– As of 2017, attendance at Pimlico had declined 57.7% since 2013 – declining  18.8% between 2016 and 2017.

18.8% between 2016 and 2017.

– Laurel Raceway is doing better. As of 2017, attendance there has declined 17.1% since 2013 – declining 8.4% between 2016 and 2017.

– During 2017, Maryland collected taxes of $254,838 from betting at Pimlico and $404,221 from betting at Laurel. That’s total taxes from thoroughbred race betting of $659,059.

Keep in mind that these thoroughbred track data are for Calendar 2017 which is, obviously, January 1, 2017 through December 31, 2017, while the casino tax dollar amounts on the pie chart are for Fiscal 2018 which is July 1, 2017 through June 30, 2018. Back to the numbers…

Let’s focus on the $61,212,583 which is Fiscal 2018 casino revenue allocated for “Purse Dedication.” We’ll leave the $10,006,816 for the “Race Tracks Facility Renewal” for another time. Twenty percent of $61,212,583 for “Purse Dedication” goes to races at tracks for “standard-bred” horses. The other 80% or $48,970,066 goes to increase purses at thoroughbred racetracks of which there are only two. One of those thoroughbred tracks is Pimlico which is currently home to the Preakness. The other is Laurel Park, to which the owner of both racetracks is said, by some, to be considering moving the Preakness.

Let’s put it altogether…

At a time when Maryland public schools in Baltimore City, Prince George’s County and other counties need all the help they can get, in Fiscal 2017 we gave $48,970,066… actually, $71,219,399 in total, but more specifically $48,970,066 to jack-up purses at just 2 Maryland tracks owned by one company, The Stronach Group… to just 2 tracks at which attendance and wagering have been declining for years, and that in 2017 produced taxes from betting of only $659,059.

In what world does that investment of state, casino-related taxes make sense?

And because the law is specified in terms of percentages of casino revenues, the amounts of the subsidies we’re giving these 2 racetracks continue to grow as public interest in racing declines. These subsidies continue to grow, mostly for the benefit of one company that happened to have been tight with Governor O’Malley and, to a lesser extent, Maryland horse breeders who, bless their hearts, are few in number and relatively well off.

Sure, horse breeding and racing are long, long-term Maryland traditions. So is giving our children – all our children – the highest quality public education we can afford. We’re not suggesting that breeding and racing go out of business, but only that we set our priorities and let the horse racing sector, like most of the business in our Maryland economy, fend for itself.