It’s a simple question: You make $58,000 a year. Would you be willing to move your family from the suburbs to the city for $69 per month?

According to a January 29, 2016 article in the Sun, legislators in Annapolis will be approving Mayor Rawlings-Blake’s request to use property tax credits to convince the majority of the city’s police officers and firefighters who don’t live in the city to move here. Currently, 72% of the city’s police and 64% of firefighters live in the suburbs.

The assumption is that more police living here will result in a police department that is more visible and more vested in the city it protects and serves. But this post isn’t about whether that’s a valid assumption. It’s about the economics of what the Mayor is proposing and the state legislature is expected to approve by the end of the current session.

Round numbers and according to various source, the average patrol officer and firefighter makes a gross income of $58,000 per year. A commonly accepted rule of thumb is that a person can afford a house that costs 2.5 times his or her gross annual income. 2.5 times $58,000 is $145,000, so that’s the price of the house a person making $58,000 can afford – not including the beneficial impact of spousal income if the officer or firefighter is married and the husband and wife are both working.

At 2.248% which is the current Baltimore City property tax rate, a family living in a $145,000 home is going to pay annual property taxes of $3260.

To encourage these public servants to move into the city, the Mayor is going to offer them a credit of $2500 or $208 per month. So let’s think about that number.

The police officer or firefighter who currently lives in the suburbs made a carefully considered decision to do so. Why? In no particular order, here are some of the reasons…

- Safer environment.

- More attractive environment.

- Greater value for his or her residential investment.

- Better public education for his or her children.

- Better, more convenient shopping.

- Already significantly lower property taxes. Baltimore City property taxes are almost twice the second highest county rate in the state.

The only negative to living outside the city is the commute.

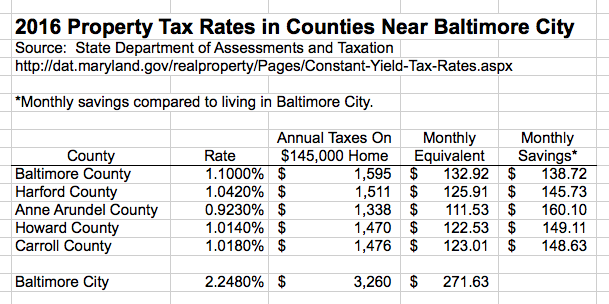

About the last bullet, the rate in Charles County which has the second highest rate in the state is only 1.2050%. And here are the rates in the immediate suburbs:

Okay, for the sake of discussion, let say that choice is between living in Baltimore County – which surrounds the city on 3 sides – or moving to the City. As you can see from the table above, living in Baltimore County in a $145,000 house is already $139 per month cheaper than living in that same house in Baltimore City. The Mayor is going to offer you a gross savings of $208 per month relative to Baltimore City property tax rates, dropping the city property taxes on your $145,000 house to the equivalent of $63,63 per month – versus the $132.92 per month you’re currently paying in Baltimore County. That’s a net savings of just $69 per month given that property taxes in the County are already much lower.

So the question is, “Are you, Mr. or Ms. Police Officer or Firefighter willing to give up the advantages of living outside the city listed above for $69 per month?”

Of course not. If the city wants expatriate police and firefighters to move her, they need to offer them, for free, city-owed vacant property and 0% financing for refurbishing or building new housing – in addition to lower property taxes. Now that might be an offer they can’t refuse.

And then there’s the impact on city revenues because you really have to make the same offer to all the police and firefighters who are already living here, don’t you?